Announcing CC Insights from Climate Capital

What is Climate Capital, and why create CC Insights?

Welcome to the first edition of CC Insights: the Climate Capital Newsletter! Climate Capital has been investing in early stage climate founders for almost a decade. This newsletter shares what we are learning about the early stage climate tech ecosystem. If you are interested in climate change solutions, startups, and/or venture capital, this newsletter is for you! To learn more, visit climatecap.co or invest with us here.

You are receiving this because you are already a valued member of the Climate Capital community. If you’d like to opt-out, we understand! You can update Substack email notifications for CC Insights under “Manage Subscription”. If you like it, we’d appreciate your help sharing this new newsletter on Twitter & LinkedIn.

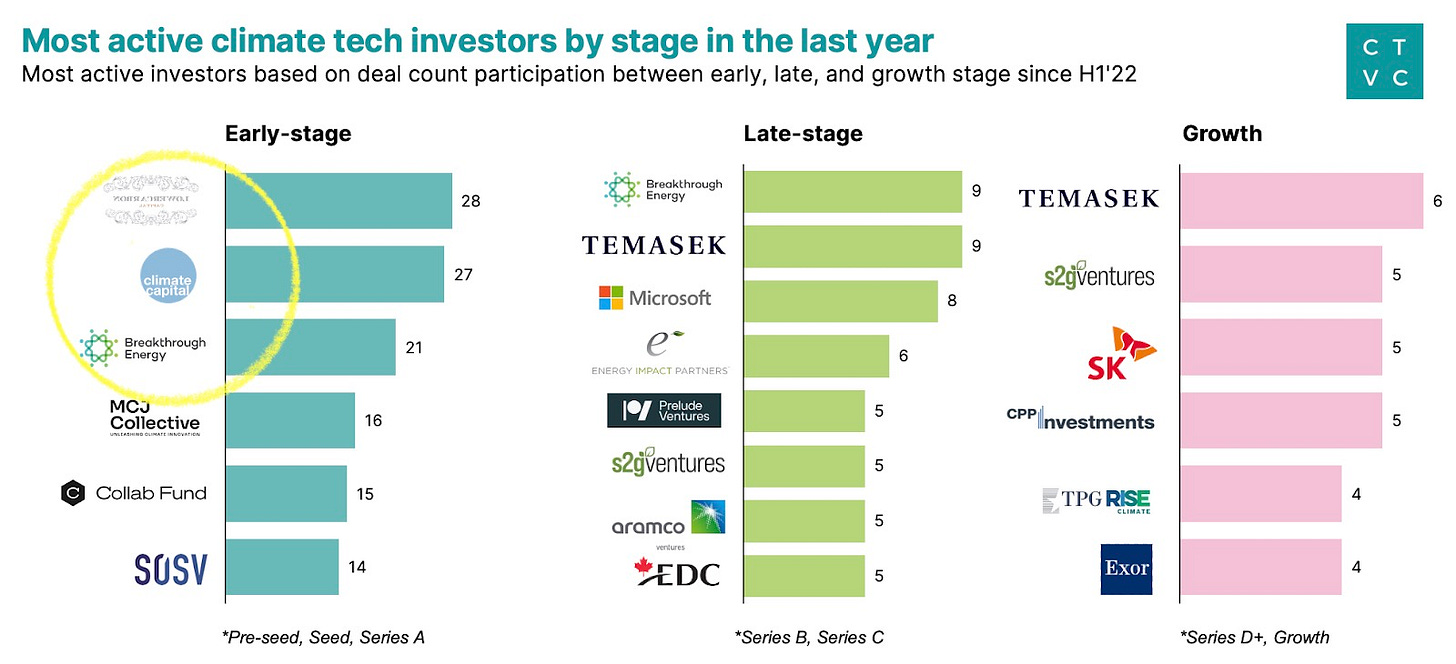

Climate Capital backs exceptional founders addressing emissions reduction & climate adaptation. We invest in early-stage companies and are one of the most active funders of climate tech in the world.

(CTVC, 6/30/2023)

The Climate Capital Syndicate

There's no doubt that climate change is an existential crisis that demands bold action. The bold action needed to save the world also represents an ~80 trillion dollar opportunity to build a better and more sustainable future. Investing in early-stage climate founders is both a generational opportunity for returns and a solution to a generational problem.

Our approach is quite different from the other names on the graphic above. Most large climate investors are traditionally-structured venture capital firms (firms that invest in startups) that are funded by foundations, pension funds, and other institutions. They often have 7 or 8 figure investment minimums. By contrast, the Climate Capital Syndicate is open to any accredited investor, with no membership fees or entry costs, and most deals require a minimum investment of just $1,000. We pool these investments into special purpose vehicles (SPVs) to fund outstanding, groundbreaking early-stage climate tech companies. Each syndicate member is able to read our investment memos and decide for themselves whether or not to invest in any given startup.

We have yet to come across another place where non-institutional or non-uber-wealthy investors can find the breadth of access that we offer to invest in the world’s most compelling climate tech startups. If you’re an accredited investor yourself, you should join, really. 🚀

How Climate Capital started and where it’s going

Climate Capital was started in 2015 by Sundeep Ahuja, spurred on by his passion for climate and entrepreneurship (see his climate focused book, HALINE, “Hunger Games meets climate change,” and TV show, Last Glimpse, “a visit to the Maldives which faces rising sea levels”).

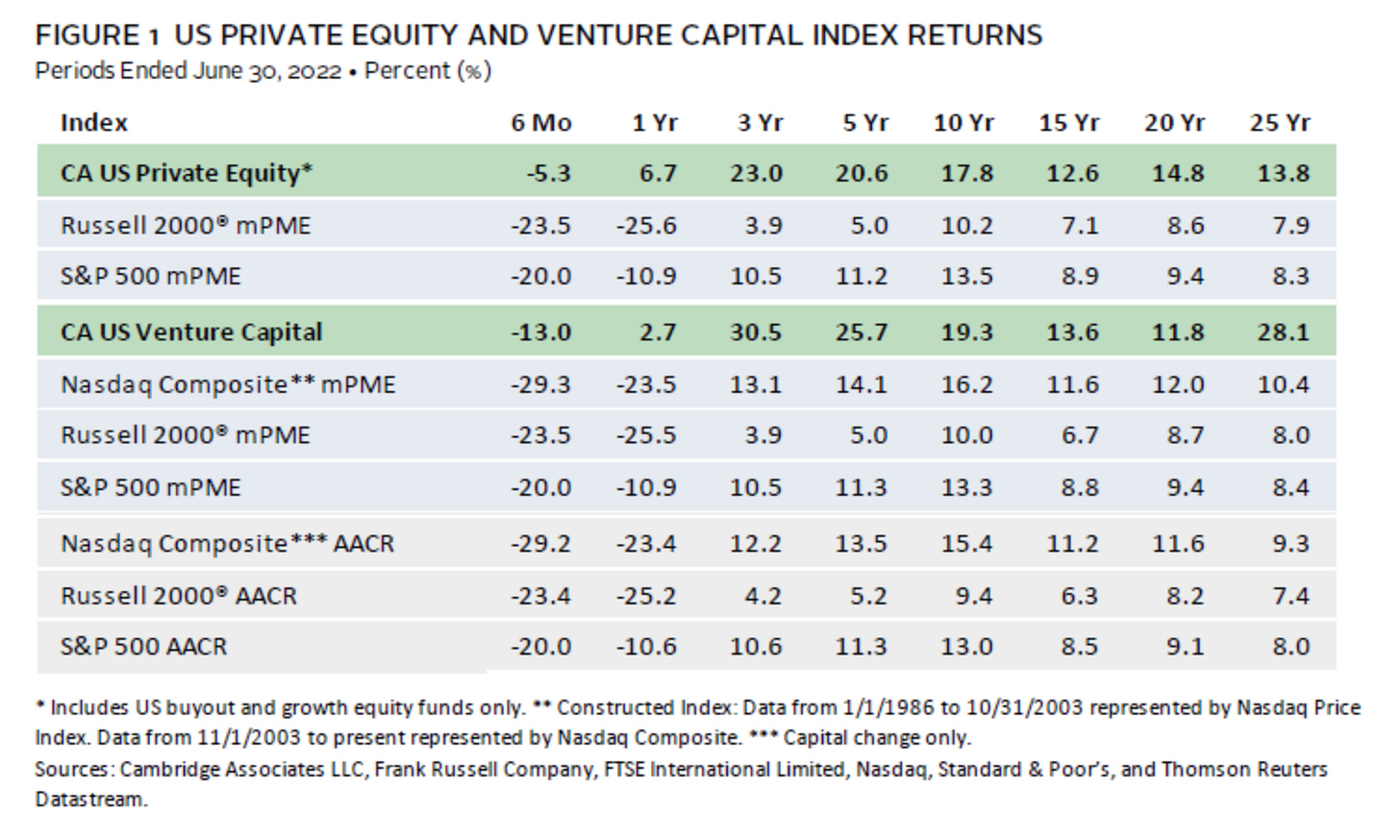

Climate Capital began to evolve into a full-fledged firm in 2020 when Sundeep brought on Michael Luciani (your writer, hi!) as a cofounder to the Climate Capital Syndicate. Our vision: to democratize VC climate investing. Why? Venture capital (investing in startups) is the highest performing asset class of the past 20 years and climate innovation is both the largest economic opportunity and greatest moral imperative of our generation (yes, even bigger than AI).

We believe an all-hands-on-deck approach is a win-win for both investors and founders. It gives more people access to the VC-based economic upside that has historically been reserved for the ultrawealthy while facilitating access to needed capital for entrepreneurs. Climate Capital Syndicate connects the many accredited investors who are interested in climate tech startups to the many climate tech startups that need that support.

Today there are three components of Climate Capital:

A community of climate founders, investors, and experts

The Climate Capital Syndicate

A series of small traditional venture funds

Each of these verticals are managed independently but we act as one team across all of Climate Capital with consolidated sourcing and portfolio support resources to accelerate outcomes. This “platform” approach has allowed us to build expertise in specific verticals and across stages while leveraging efficiencies of scale and staying true to our focus on democratizing access to this asset class.

Hot New Talent

In addition to increasing access to climate tech for investors, Climate Capital increases access and opportunity for emerging investment managers. Our community of experienced investors not only curates deals for the syndicate, but is constantly scouting for talented people to join our team.

There are hundreds (maybe thousands?) of brilliant people working in investment firms who are passionate about climate, but who don’t have a chance to implement their own ideas. Many people who work in tech and/or climate as founders or operators see great companies, but don’t have the capital or time to invest. Climate Capital is a place where such people can learn to put investments together, build track records of success, and hone their investment theses (even on a part-time basis!).

New investment managers joining the syndicate team are mentored by experienced investors, supported by an expert network, and all deals are reviewed by our investment committee. Each investment manager has access to all of Climate Capital’s considerable deal flow and is free to pursue the companies that they feel are most compelling.

Not only does "emerging" investment talent historically outperform more established funds, empowering emerging talent allows us to be dynamic in finding and supporting the best founders who, like emerging investors, often come from outside of legacy networks. First-time managers generally outperform experienced venture capital managers.

The world of VC investing can be damn near impossible to break into. You have to have direct investing experience (leading SPVs, not just investing into other people’s SPVs) in order to build a track record as an investor. CC Syndicate is a rare exception to that circular logic.

Hi, I’m Michael.

In 2020, I sold the company I had founded. When I was building that company, I came to learn what a powerful engine venture capital funding can be for growth. My company simply couldn’t have gotten off the ground without early investors like Reid Hoffman, Eric Schmidt and Chris Sacca who believed in us. Because of that experience, I knew I wanted to invest in and support other emerging entrepreneurs who were building something that could change the world for the better. I joined the Climate Capital Syndicate and was exposed to fantastic climate startups – I loved the companies and invested in many. Over time, I transitioned from being a participant to becoming a partner in the leadership team.

I am one of those emerging managers at Climate Capital. During my time with CC I have led over 60 different investments. I have co-invested with most everyone on the graphic at the beginning of the email and many of the “blue chip” non-climate VC funds. I’ve made seed investments into now unicorn companies and, most importantly, I’ve had the rare opportunity to begin to learn the craft of early-stage investing. I’ve developed an investing thesis, built a track record, and am now halfway through raising my first fund, a 506(c) called Climate Capital Bio, with the brilliant Dr. Jenny Kan.

The unique structure of Climate Capital allowed me to discover that being an early-stage climate investor is what I wanted to do with the rest of my professional life. Without Climate Capital, I may not have had the chance to learn that. Without Climate Capital, it would have taken many years longer for me to build the track record I’ve needed to raise my first fund. This community gave me the courage and support necessary to take this leap, and I couldn’t be more grateful for that.

If you’re passionate about solving climate change and want to invest in the early-stage startups that are doing so – helping planet-saving solutions scale faster than would otherwise be possible! – this is the place to be. Whether it is as a reader, a syndicate member, or a part of the wider community (more on that later 🙂), I invite you to join us!