Climate Capital has invested in 300+ climate startups since 2015. CC Insights shares what we are learning about the early stage climate tech ecosystem. Co-invest with us.

Climate Angels starts this Friday with speakers and mentors from Lowercarbon, MCJ Collective, Planeteer, Earthshot, Climactic, Voyager and more; 2 spots remaining: https://climateangels.vc

This post is written by Jennifer Turliuk on the Climate Angels team: Principal at Climate Capital, angel investor, entrepreneur (acquired), board member, mentor/advisor, author, keynote speaker.

Many of the climate solutions in the Project Drawdown Table of Solutions involve new technologies and innovations, and/or applications of them. How do we implement them? There’s one thing most new technologies and ventures need to help them get off the ground: funding.

According to the IEA, “The world is set to invest a record USD 1.8 trillion in clean energy in 2023: this needs to climb to around USD 4.5 trillion a year by the early 2030s to be in line with our pathway” [to 1.5C]. And for the record, this is for the 1.5C target which we have practically blown through.

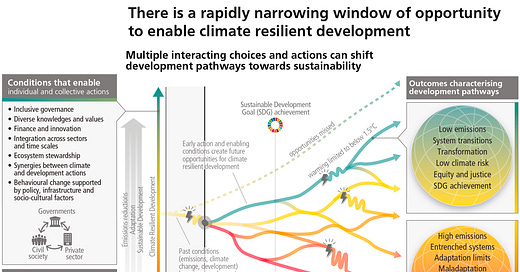

The IPCC includes finance and innovation enabling conditions for progress - and lack thereof as a condition of failure:

The IPCC also highlights finance and technology as a suggested response in the near-term: “Finance, technology and international cooperation are critical enablers for accelerated climate action. If climate goals are to be achieved, both adaptation and mitigation financing would need to increase many-fold. There is sufficient global capital to close the global investment gaps but there are barriers to redirect capital to climate action. Enhancing technology innovation systems is key to accelerate the widespread adoption of technologies and practices.”

Finance is a key lever that can be used to move the needle on climate change.

What types of finance are needed? Here is a look from CTVC at some of the types of financial instruments used at different stages of a new technology’s TRL (Technology Readiness Level):

As you can see, one of the key instruments is venture financing. Angel investing and venture capital are funding the businesses of the future, and in doing so, helping define the set of future solutions.

Where should this funding be going? While historically a large amount of it has gone towards “traditional VC” companies (SAAS, social networks, etc.), I would argue that with the depth of the climate crisis facing us, many more dollars should be going towards the future we want to create: ideally, a livable one. Remember how Kodak pioneered digital photography, but never pushed it much because it would cannibalize the film business, and then went out of business? Incumbents not making the short-term investment in electrification/decarbonization today are risking their whole business in the long-term (like Kodak did).

In 2023, the share of VC and PE funding going into climate tech accounted for 10% of private market start-up investments (PWC). There may be a $2 trillion private funding gap for next-generation climate technologies by 2030 (Deloitte). This funding is needed in order for us to achieve the goal of limiting global temperatures to 1.5°C by 2030 (Deloitte).

Increased funding is needed across all climate tech areas to enable breakthrough innovations and trigger sectoral tipping points, whilst also supporting commercially ready technologies to scale up over the next decade. I’ve heard it said that we need to redirect the flow of three things to facilitate the transition: energy (electrical), capital, and talent (human energy) - climate tech venture investing can help do all three.

Not only is climate tech venture investing impactful for reducing climate change, but it also offers an opportunity for significant financial returns. While some climate technologies have moved well beyond a proof of concept, there are still significant areas of untapped potential. Our whole world is being rebuilt.

By investing in climate tech, I believe I can make an impact and change the world for the better, for our generation and generations to come — and so can you. It could be the biggest investment opportunity in history (see Chris Sacca’s take).

Want to learn more about climate tech angel investing?

Check out Climate Angels, a new educational initiative built in collaboration with Climate Capital, to help more people learn about climate tech angel investing. Our flagship program starts Friday, January 12, 2024 and we have two spots remaining: https://climateangels.vc.

The program will be taught by senior leaders from Climate Capital, and we’re excited to welcome guest speakers such as:

Shawn Xu (Partner at Lowercarbon Capital)

Sophie Purdom (Managing Partner at Planeteer Capital; Co-Founder, CTVC)

Leo Banchik (Director at Voyager Ventures)

Cody Simms (Partner at MCJ Collective; Co-host, My Climate Journey podcast)

As well as mentors including:

Matt Logan (Partner with Earthshot Ventures)

Peter Sun (part of the founding team at Climactic)

We hope to see you (virtually) there! Not sure if Climate Angels is right for you? Email Jenn at jenn@climateangels.vc

–

Note: The Author’s opinions are their own and not necessarily representative of Climate Capital.

Disclaimer: Under no circumstances should any information or content in this email be considered an offer to sell or solicitation of interest to purchase any securities, including any securities advised by Climate Capital or any of its affiliates or representatives. Further, no content or information herein is or is intended, nor should it be construed as, an offer to provide any investment advisory service, financial advice, legal, tax, accounting, investment, or other advice from Climate Capital or any of its affiliates (collectively "Climate Capital”). Under no circumstances should anything herein be construed as fund marketing materials by prospective investors considering investing in any Climate Capital investment fund. Content contained herein does not constitute an offer to sell — or a solicitation of an offer to buy — any securities and may not be used or relied upon in evaluating the merits of any investment. Information regarding companies highlighted herein has been provided by third parties, and Climate Capital makes no representations or warranties as to its accuracy, as to the viability of any company listed herein, or the results of any investment in a listed company.