Climate Capital has been investing in climate founders for almost a decade. CC Insights shares what we are learning about the early stage climate tech ecosystem. Co-invest with us here.

Hello and welcome to the second edition of CC Insights! We had a great response (57% open rate) to last week’s newsletter, and helpful feedback - please keep it coming. This week, we (Michael & Ian) are excited to bring you:

What CC Syndicate invested in - H1’23

A general update on the climate investing space

(Fun!) Regulatory updates from CC Bio

With that, let’s get into it:

H1’23 CC Syndicate Investments.

Here’s a look at what the Climate Capital Syndicate invested in during H1’23 (at least, what we can share publicly!). Note, this does not include investments made by CC Bio or the Climate Capital Rolling Fund.

3E Nano (Seed)

3E Nano is revolutionizing window insulation with nanotechnology coatings that enable the production of triple-paned windows at double-paned costs. Improved insulation leads to energy-efficient buildings. The investment round was led by Energy Foundry, with participation from MUUS Climate Partners, Creative Ventures, New Climate Ventures, and ACT among others.

Found Energy (Pre-Seed+, we initially invested at Pre-Seed)

As part of the Activate Fellowship, Found Energy is scaling technology to store and deliver hydrogen on-demand safely, with the goal of 5x the volumetric energy density of liquid hydrogen and 3x that of methanol and ammonia.

Gradient (Series A)

Gradient is transforming building heating and cooling with simple, affordable, and leak-free heat pumps. Their technology is accelerating electrification in the US and worldwide with easy-to-install, cost-effective, and aesthetically pleasing hardware. Investors in this round include Ajax, Sustainable Future Ventures, At One, Safar, and Impact Science.

Ever.green (Seed)

Ever.green focuses on two areas: 1) RECs with additionality and 2) a newly possible tax credit marketplace. Serving corporate customers like REI and Stripe, Ever.green holds a strong first-mover advantage. The seed round is co-led by Designer Fund and Pioneer Square Labs, with participation from Baker Tilly, Fin Capital, and City Light Capital, among others.

Piersica (Seed, we initially invested at Pre-Seed)

Piersica is developing solid-state lithium batteries with energy densities more than 2x that of today's commodity lithium-ion battery cells.

Photon Marine (Seed, we initially invested at Pre-Seed)

Photon Marine is developing EV propulsion systems for B2B marine fleets, starting with marine tourism and transportation (whale watching, scuba, and snorkel operators, etc). Similar to EV cars, EV boats will have fewer parts to maintain, better performance, and are environmentally friendly.

unspun (Series A, we initially invested at Pre-Seed)

unspun is revolutionizing fashion with on-demand, automated, and sustainable clothing production. They are building the first end-to-end scan-to-production system that takes your exact body measurements and rapidly produces custom-fitting clothing with robotic 3D weaving. The company’s denim jeans have a 92%+ customer satisfaction rate.

New Sun Road (Series A)

New Sun Road provides the technology to manage power systems at scale. The microgrids they facilitate accelerate 1) the global deployment of renewable energy and 2) grid resilience in times of climate-driven hazards.

Bluedot (Seed)

Bluedot is a banking and rewards platform for EV owners that aims to enhance the post-sales experience. Bluedot makes EV charging payment easier and simplifies expense management for drivers and fleets.

Colossal (Series B, we previously invested at Seed and A)

Colossal Biosciences is a biotechnology and genetic engineering company working to genetically resurrect the wooly mammoth, the Tasmanian tiger, and the dodo.

Magrathea Materials (Seed, we initially invested at Pre-Seed)

Magrathea is creating a $100B+ market for magnesium to be used as a low-carbon, low-cost, lightweight structural metal - dramatically reducing CO2 emissions and the need for mining. They are developing a new generation of process technology for making magnesium metal from wildly abundant brines and seawater.

…and 19 stealth investments!

General Market Updates

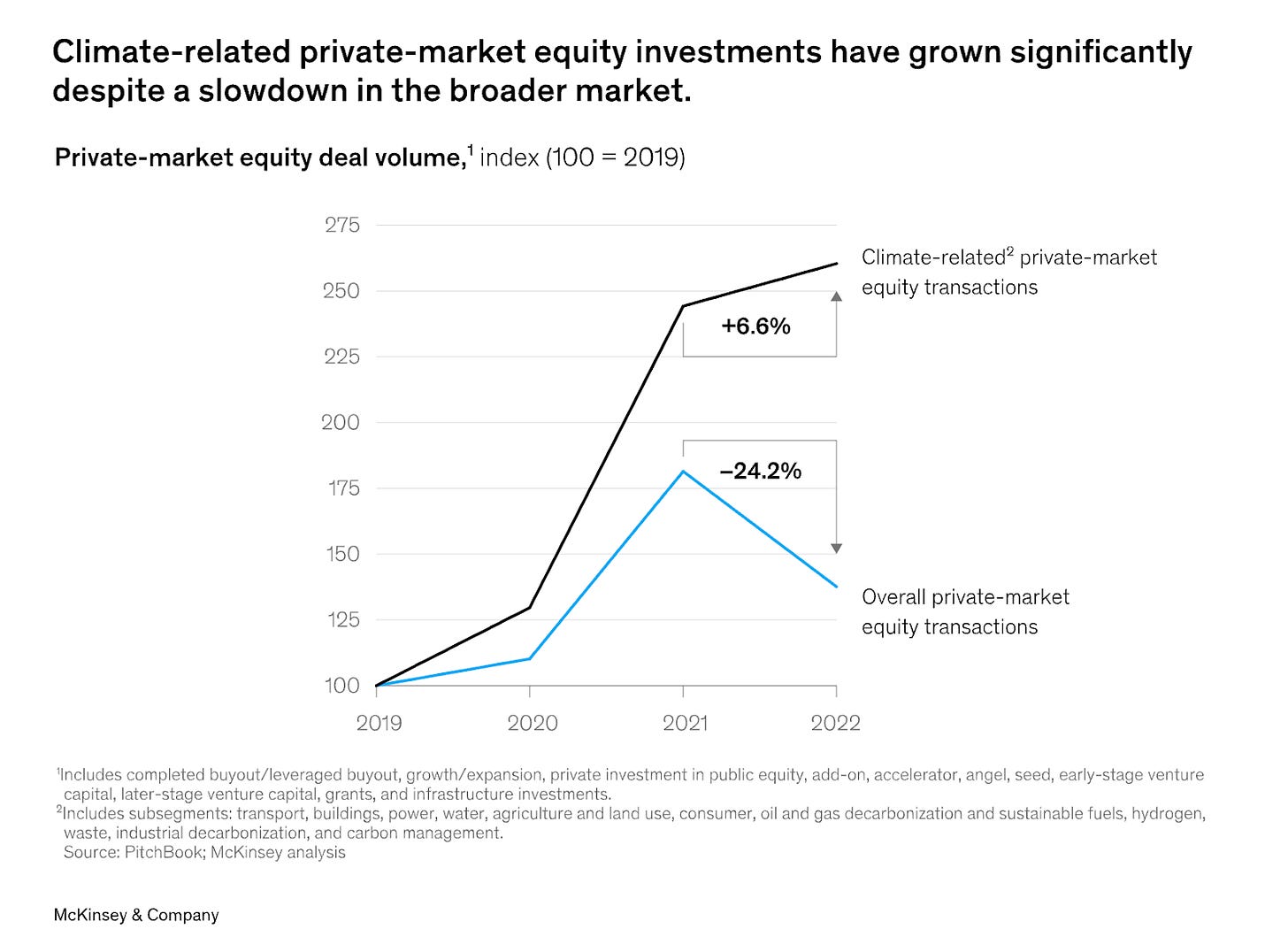

A new report by McKinsey on the continuing performance of climate investing finds that the current momentum suggests that the space is breaking out—not breaking down—in the face of market complexity.

Last year, Russia’s invasion of Ukraine, the resulting energy crisis in Europe, turmoil in the global economy, and a slowdown in markets all generated concern that a three-year period of growth in climate technology investment was ending. That reality hasn’t materialized, as measured by investment in the area.

The momentum seems poised to continue in 2023 as governments, corporations, and investors increasingly accelerate the deployment of climate technologies, which offer the potential to promote energy security, affordability, and sustainability objectives. European nations, for example, are speeding up their long-term plans for local renewables, even as many seek to offset cuts in Russian energy imports by boosting supplies of gas, coal, and oil in the shorter term.

Climate technology is getting a further boost from unprecedented government programs in the United States and Europe that will unleash a flood of capital to meet the challenge of achieving net-zero emission commitments by 2050. The US Inflation Reduction Act (IRA), passed last year, allocates more than $370 billion in funding to mitigate climate change, while the EU Green Deal could potentially dedicate more than €1 trillion in public and private funds to the fight. Together, these measures may open up more opportunities for investors in a market that McKinsey estimates could reach $9 trillion to $12 trillion in annual investment by 2030.

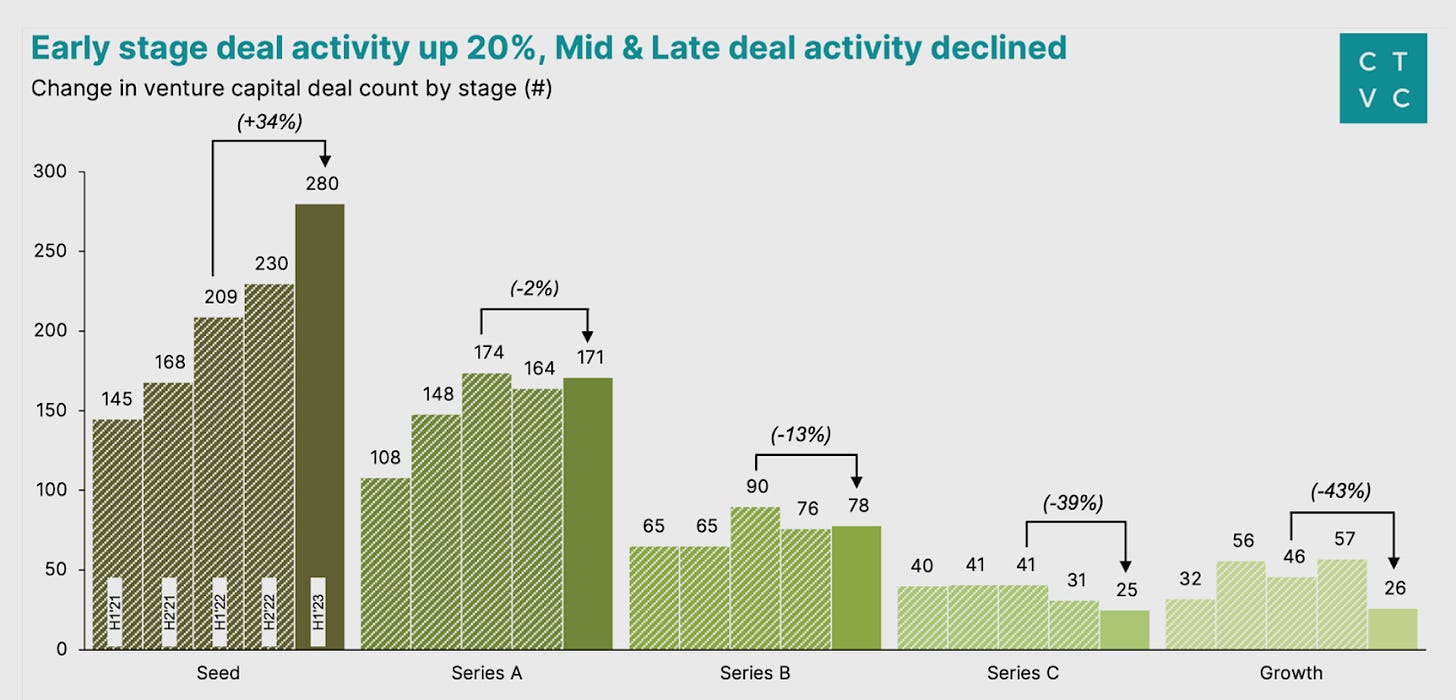

CTVC’s recent market update is also excellent and tells a more nuanced story (source). TL;DR: yes, private markets climate investment has slowed down – but significantly less than investment in everything else.

This is affecting different stages of venture investing in climate differently. Pre-seed and seed funding is actually up: seed funding grew 23% in H1’23 compared with H1’22, and seed deal count increased 34% during the same period. Investment in Series B and beyond in climate tech has decreased both in number of deals and deal size; ‘growth’ funding (Series C and beyond) bore the brunt of the market contraction and plummeted 64%, while deal count dropped 43%.

As an investor focused on pre-seed companies we anticipate it will be 36 months or more before our seed stage Climate Capital portfolio companies are raising a Series B round, and we anticipate that conditions will be different then.

This consistency is what has allowed Climate Capital to build such a strong brand over the past 8 years and is one of Climate Capital's competitive advantages in attracting the best inbound deal flow of startups looking for funding.

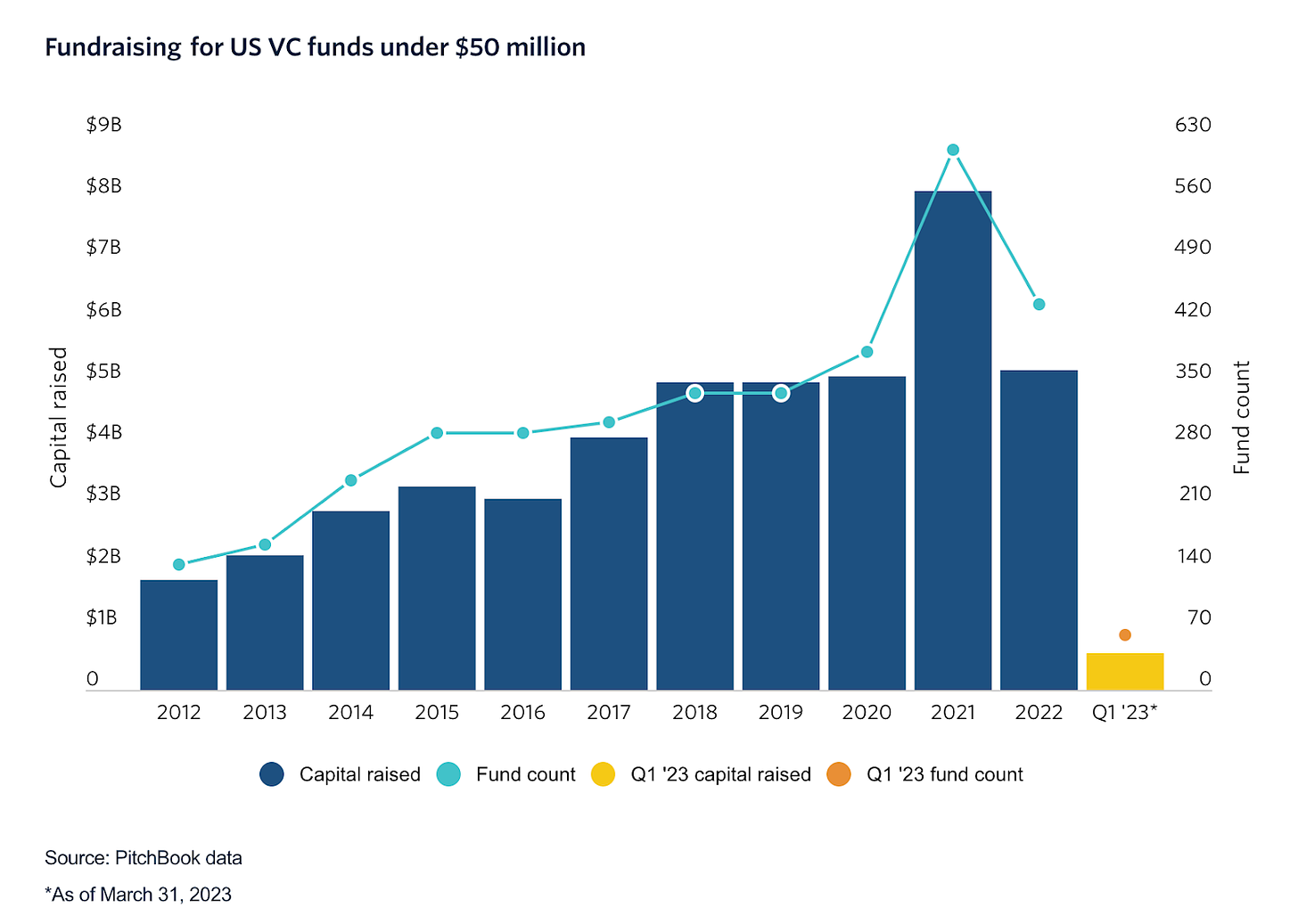

Funding:

It will surprise no one to hear that the last 6 months have been a difficult time to fundraise. In this chart from Pitchbook, you can see that funding to US VC funds under $50M has dropped by more than 50%. We know from the data and anecdotal evidence that we are actually in the top decile of fundraising success for small and emerging funds - both for our funds and for our SPVs. 🎉

(Fun!) Climate Capital Bio Regulatory Updates

Climate Capital Bio tracks regulatory updates on biotech closely. This is an excerpt from their recent quarterly update to LPs.

This month saw approvals from both the FDA and USDA for ‘cell cultivated’ meat. You may have tried an Impossible or Beyond Burger - plant based meat alternatives. Cell cultivated meat is an entirely different ball game because these products are cellularly identical to organic meat - meaning no sacrifice in terms of taste!

The USDA approved labels for chicken grown from cells in bioreactors produced by Upside Foods and Eat Just. Their products will be labeled “cell-cultivated chicken” when it is sold and served to the public. These are the first labels that have been approved for the nascent segment by the USDA. The approval answers the question of what this new type of food will be called as it moves mainstream.

GOOD Meat's ‘cell-cultivated’ chicken received FDA approval for human consumption. GOOD Meat is the second cultivated meat product to receive a "no-questions" letter from the FDA after California-based UPSIDE Foods got the green light for its cultivated chicken breast last November. The letter means the FDA accepts the company's conclusion that its product is safe for humans to eat.

Ending on a fun note (as promised):

Acclaimed chef José Andrés (on GOOD Meat's board of directors) plans to serve GOOD Meat's cell-cultivated chicken to customers at his Washington, D.C. restaurant. Michael is eager to give this new meat a try and would love to have dinner with any of you to try whatever José Andrés cooks up with GOOD Meat’s chicken - if you want to join, send him a note at michael@climatecap.co.